Intense Competition and Limited Inventory Drive Strong Surge in GTA Real Estate Market: Analysis of April Data and Market Outlook

April 2023 Greater Toronto Area Market Statistics

The real estate market in the Greater Toronto Area is experiencing a surge in demand that is not being met by the limited inventory available. This has led to intense competition amongst buyers, resulting in properties selling quickly and often above the asking price. As a result, the average sale price of homes has increased across all market segments.

The average home sale price in April reaching an impressive $1,153,269, representing an 11% growth of $114,601 from the recent market low recorded in January. One of the main drivers of this price surge is the remarkably low inventory levels observed so far this year, as evidenced by the total inventory of 10,373 properties in April, which is down 21% year-over-year and a striking 33% lower than the ten-year April average of 15,421 active listings.

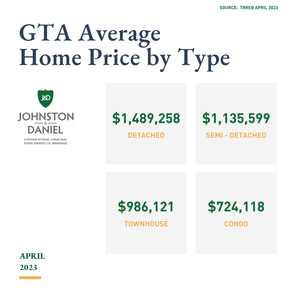

The detached market has seen a rise in the average sales price, which increased to $1,489,258 in April, 11% or $147,410 higher than in January 2023. The low levels of inventory are particularly apparent in the detached market, with only 4,536 active listings, which is down 26% year over year and 43% from the preceding ten-year average for April data. Low inventory is driving buyers to compete over the limited properties that are available. Numerous properties have received multiple offers, leading to a significant decline in the average days on the market, from 27 days in January to just 15 days in April. Properties sold in April were able to achieve 103% on average above the asking price, indicating the intensity of the competition.

The condo and townhouse markets have also seen average values rise to $724,118 and $1,093,560, respectively. Inventory in both markets is still very low, with only 3,944 condos and 616 townhouses available for sale in April. Nevertheless, this did not deter buyers from being active, as there were 2,160 condo sales in April, the highest sales total since April of 2022, the condo market currently has only 1.82 months of inventory, while the townhouse market has less than 0.96 months’ worth of listings available.

As discussed in the recent Royal LePage National release, The Bank of Canada’s overnight lending rate is holding at 4.5 percent. The central bank has indicated that it will maintain the rate at its current level if inflation continues to come down. “This was the signal that so many Canadians were waiting for. The Bank of Canada’s rate hold was the green light that stability is returning to the market, and it has had a swift and significant impact on buyer demand,” said President and CEO of Royal LePage Phil Soper.

These thoughts are echoed by TRREB President Paul Baron, “In line with TRREB’s outlook and recent consumer polling results, we are seeing a gradual improvement in sales and average selling price. Many buyers have come to terms with higher borrowing costs and are taking advantage of lower selling prices compared to this time last year. The issue moving forward will not be the demand for ownership housing, but rather the ability to meet this demand with adequate supply. This is a policy issue that requires sustained effort from all levels of government,” said Paul.

Not only are GTA values trending higher but real estate values nationally have begun to follow suit. While price trends are currently moving upward, there are potential headwinds on the horizon if those with variable rate mortgages run into trouble keeping up with payments that in some cases have doubled over the past year. This could lead to an influx of properties entering the market, which would be a welcome development given the current low inventory levels. If this surge in listings were to materialize, it could halt the current trajectory of price increases. Without more inventory, we can expect price appreciation to continue.

The average selling price was $1,153,269 as compared to $1,108,606 the previous month. The average price is below last year’s average of $1,250,704.

The average number of listing days on the market was 17, down from 19 in March 2023. Total active listings were down 20.8% year-over-year, and new listings were down 38.3% year-over-year, from 18,146 in April 2022 to 11,364 in April 2023.

Benchmark price by home type (all TRREB reporting areas):

- The benchmark price for detached homes was $1,462,500, 12.2% lower than in April 2022.

- The benchmark price for attached homes was $1,116,900, 11.6% lower than in April 2022.

- The benchmark price for townhouse homes was $833,700, 12% lower than in April 2022.

- The benchmark price for condo apartments was $714,300, 12.2% lower than in April 2022.

Average price by home type (416 and 905):

- The average price for detached homes was $1,489,258, 8.3% lower than in April 2022.

- The average price for semi-detached homes was $1,135,599, 9.8%lowerthan in April 2022.

- The average price for townhouse homes was $986,121, 3.2% lower than in April 2022.

- The average price for condo apartments was $724,118, 8% lower than in April 2022.